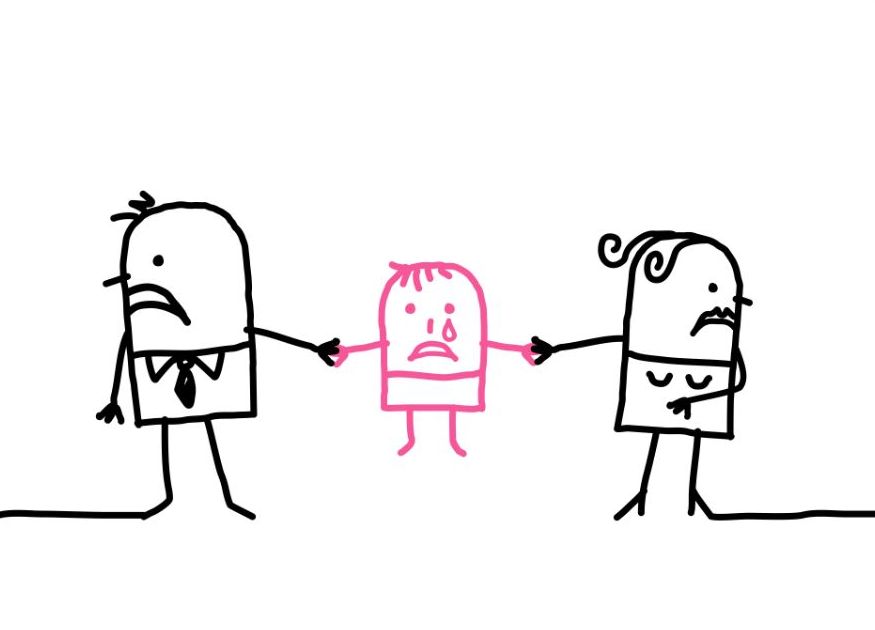

A Florida divorce involving children or a paternity action will require, by Florida Statute, a determination of child support. Florida child support is based on a few factors, which are defined by Florida Statute. The factors considered in the child support calculation are the incomes of the parties, daycare costs, and health insurance costs. Understanding how Florida Statutes define these factors is key to understanding child support and how it is calculated.

A Florida divorce involving children or a paternity action will require, by Florida Statute, a determination of child support. Florida child support is based on a few factors, which are defined by Florida Statute. The factors considered in the child support calculation are the incomes of the parties, daycare costs, and health insurance costs. Understanding how Florida Statutes define these factors is key to understanding child support and how it is calculated.

Under Florida Statute 61.046, the Florida legislature established definitions found throughout the statutes involving divorce and child support cases. When calculating child support, the party that pays the health insurance costs actually receives a credit for such. Florida Statute 61.046(7) defines heath insurance as, “coverage under a fee-for-service arrangement, health maintenance organization, or preferred provider organization, and other types of coverage available to either parent, under which medical services could be provided to a dependent child.” This means that a party may have healthcare coverage under any of these types of scenarios, which also covers the children of the parties.

Jacksonville Divorce Lawyer Blog

Jacksonville Divorce Lawyer Blog

Florida is a “no-fault” divorce state. The idea is that you do not litigate why you are divorcing, but simply litigate a resolution to the divorce (i.e. distribution of assets, child support, alimony, etc.). To that end,

Florida is a “no-fault” divorce state. The idea is that you do not litigate why you are divorcing, but simply litigate a resolution to the divorce (i.e. distribution of assets, child support, alimony, etc.). To that end,

Child support and alimony laws of Florida often go hand-in-hand. In Florida, child support is calculated based on the income of both parties. In Florida,

Child support and alimony laws of Florida often go hand-in-hand. In Florida, child support is calculated based on the income of both parties. In Florida,

In a divorce or other child support case, I am often asked which parent can claim the child as a tax exemption. According to

In a divorce or other child support case, I am often asked which parent can claim the child as a tax exemption. According to  In Florida, child support is determined based on the

In Florida, child support is determined based on the  As a Florida family law attorney, I often have calls from men that have been served with paternity papers who have just discovered they have a teenage child. Often, these men have already started their own family by the time they are told about the child and now they are looking to pay child support for the benefit of a kid they do not know. Florida law understands this can be an issue, so it only allows back child support only be calculated two years from the date of filing the petition for paternity. In addition, Florida case law has established that if the father did not know of the child and has children prior to finding out about the child, then child support may be calculated giving him credit for the children he presently has. The Florida

As a Florida family law attorney, I often have calls from men that have been served with paternity papers who have just discovered they have a teenage child. Often, these men have already started their own family by the time they are told about the child and now they are looking to pay child support for the benefit of a kid they do not know. Florida law understands this can be an issue, so it only allows back child support only be calculated two years from the date of filing the petition for paternity. In addition, Florida case law has established that if the father did not know of the child and has children prior to finding out about the child, then child support may be calculated giving him credit for the children he presently has. The Florida