Written By: Lenorae Atter, Attorney at Law

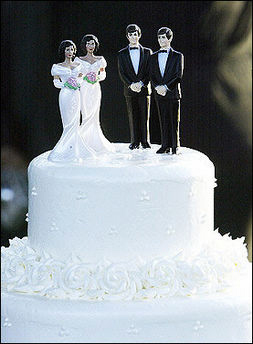

Alimony in a Florida divorce is defined by statutes for qualification purposes, but defined by judges and case law for purposes of determining the amount of alimony. However, there are questions in Florida divorces regarding men receiving alimony when they have been the homemaker and stay-at-home-dad during the marriage because, unfortunately, judges may still have gender biases. In Jacksonville area divorces, I have not yet seen a judge deny alimony to a man who met the statutory requirements showing a need for alimony; however, that does not mean it does not happen. Biases sadly play into every sector of family law though most of the biases are more subconscious than blatant. Men, however, are entitled under Florida Statutes, to receive the same consideration for alimony as women.

Alimony in a Florida divorce is defined by statutes for qualification purposes, but defined by judges and case law for purposes of determining the amount of alimony. However, there are questions in Florida divorces regarding men receiving alimony when they have been the homemaker and stay-at-home-dad during the marriage because, unfortunately, judges may still have gender biases. In Jacksonville area divorces, I have not yet seen a judge deny alimony to a man who met the statutory requirements showing a need for alimony; however, that does not mean it does not happen. Biases sadly play into every sector of family law though most of the biases are more subconscious than blatant. Men, however, are entitled under Florida Statutes, to receive the same consideration for alimony as women.

The reason this issue has arisen in 2012 is due to a recent appellate case, Gulledge v. Gulludge, 2D11-472 (Fla. 2nd DCA February 29, 2012). In this case, the couple was married for 30 years (long-term under Florida Statute 61.08) and the Wife was the primary breadwinner making approximately $60,000 per year. The Husband did not make more than $15,000 per year during the course of the marriage and at the time of divorce was making $9,000. The Husband also had a GED and a history of taking care of the children and doing the homemaking. In the divorce, the Husband was fairly and accurately requesting to receive permanent alimony (as available through Florida Statute if he can also show a need). The parties did not settle their case at mediation, so the case went for the judge to ultimately decide. The judge listened to the testimony and evidence and ruled in favor of the Wife finding that that Husband did not have a need for alimony and that he was underemployed.

The trial court’s decision was appealed and the appellate court reversed or overturned the trial court’s decision. The appellate court ruled that the Husband had demonstrated a need for alimony, but also agreed with the trial court, that he was under employed. However, no ruling by either the trial court or appellate court stated what the Husband should be earning with his GED and 30-year work history (e.g. minimal work with homecare and child keeping). The appellate court basically said that there was a need for the Husband to have alimony and that at least $1 of permanent alimony should be awarded in case the Husband could not find gainful employment, then he could have it modified.

Jacksonville Divorce Lawyer Blog

Jacksonville Divorce Lawyer Blog

Alimony in Florida is based on a number of factors, including need for alimony and the other party’s ability to pay it. Even if these factors can be proven, there is always the questions of, “How much will I get or pay?”; “How will it get paid?”; and, “Will it get paid?” Answering these questions is not always the easiest thing for Florida

Alimony in Florida is based on a number of factors, including need for alimony and the other party’s ability to pay it. Even if these factors can be proven, there is always the questions of, “How much will I get or pay?”; “How will it get paid?”; and, “Will it get paid?” Answering these questions is not always the easiest thing for Florida

An award of alimony or spousal support in a Florida divorce does not mean that the award will be valid under any and all circumstances or that it is not modifiable. Support obligations are, unless waived by agreement, always modifiable in Florida. As a Jacksonville divorce

An award of alimony or spousal support in a Florida divorce does not mean that the award will be valid under any and all circumstances or that it is not modifiable. Support obligations are, unless waived by agreement, always modifiable in Florida. As a Jacksonville divorce  Divorce cases in Florida often have an

Divorce cases in Florida often have an  A concern regarding child support and alimony, in Florida, is that once it is ordered, the other party will not pay. As a Jacksonville, Florida divorce and family law

A concern regarding child support and alimony, in Florida, is that once it is ordered, the other party will not pay. As a Jacksonville, Florida divorce and family law  Florida divorces involving alimony issues have given rise to new legislation over the last few years and will continue into the near future. The alimony debate in Florida is based on a number of factors, including the lack of an alimony calculation that is state mandated in determining the amount of alimony to be paid. According to a press release on Market Watch, Anderson Cooper is reportedly doing a show on Monday, January 9, 2012 highlighting the issues of Florida alimony; however, the report that came out about the show seems to have things reported incorrectly and in an effort to decrease emotional responses, I thought, as a Florida

Florida divorces involving alimony issues have given rise to new legislation over the last few years and will continue into the near future. The alimony debate in Florida is based on a number of factors, including the lack of an alimony calculation that is state mandated in determining the amount of alimony to be paid. According to a press release on Market Watch, Anderson Cooper is reportedly doing a show on Monday, January 9, 2012 highlighting the issues of Florida alimony; however, the report that came out about the show seems to have things reported incorrectly and in an effort to decrease emotional responses, I thought, as a Florida  Florida divorce and child support laws dictate what may be paid in alimony and child support based on the facts of each case and incomes of the parties. Often, the paying party does not like the idea of writing a monthly check and the receiving party does not like worrying about whether the check is actually in the mail. Florida divorce and child support clients often ask their

Florida divorce and child support laws dictate what may be paid in alimony and child support based on the facts of each case and incomes of the parties. Often, the paying party does not like the idea of writing a monthly check and the receiving party does not like worrying about whether the check is actually in the mail. Florida divorce and child support clients often ask their Divorcing parties often separate before their divorce is finalized. When parties separate, even if by agreement, it does not mean that simply not having a court order means that a party is not entitled to alimony and/or child support. Spousal support is based on a need for support and the other party’s ability to pay, often this need is immediate and the party is entitled to receive funds from the date of the separation. Also, child support is designed to keep a child in the same lifestyle s/he would have if the parties were still living together, therefore, the need for child support is established at the time of the separation.

Divorcing parties often separate before their divorce is finalized. When parties separate, even if by agreement, it does not mean that simply not having a court order means that a party is not entitled to alimony and/or child support. Spousal support is based on a need for support and the other party’s ability to pay, often this need is immediate and the party is entitled to receive funds from the date of the separation. Also, child support is designed to keep a child in the same lifestyle s/he would have if the parties were still living together, therefore, the need for child support is established at the time of the separation.